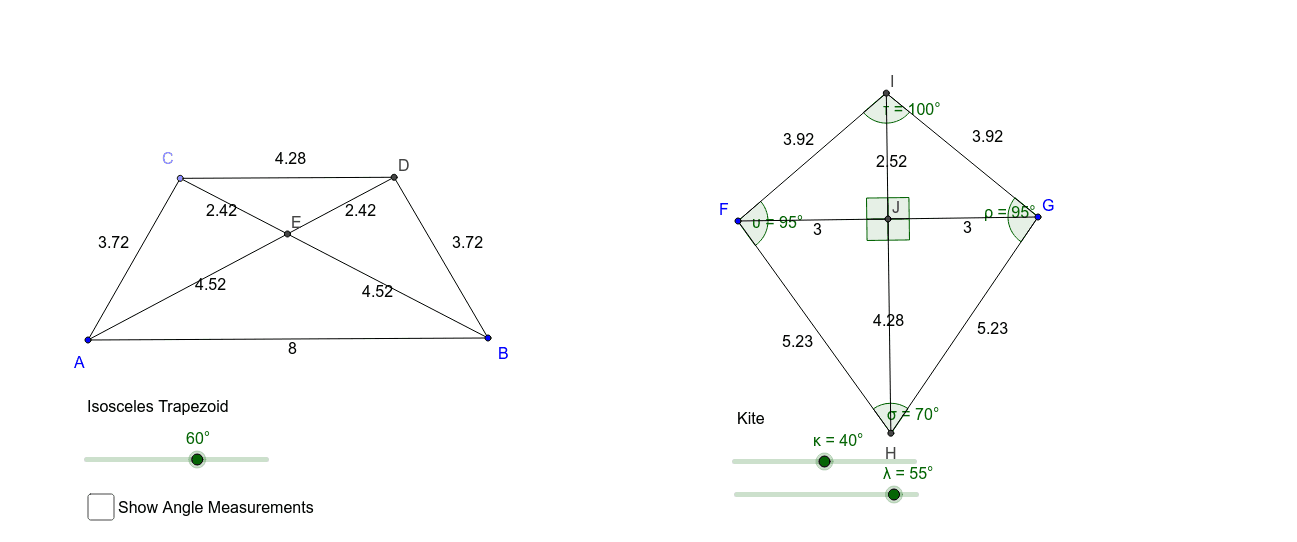

We believe this will allow us to achive our two most important goals client success, and a long-term business relationship.Ĭompany name KITE PROPERTIES, L.L.C. In conducting our business we put the interest of our clients first. We build long-term relationships based on honest, consistent and open communication with our clients. As you reshape the kite, notice the diagonals always intersect each other at 90 (For concave kites, a diagonal may need to be extended to the point of intersection. A kite is a quadrilateral that has 2 pairs of equal-length sides and these sides are adjacent to each other. If the two non-parallel sides are equal and form equal angles at one of the bases, the trapezium is an isosceles trapezium. The other two non-parallel sides are called legs. This focus provides our clients with the market knowledge they need to make informed decisions. In the figure above, click 'show diagonals' and reshape the kite. Properties: The parallel sides are called bases. We provide in-depth expertise for single-tenant net lease, shopping centers, office and healthcare properties. Our exclusive focus is on the sales and leasing of retail, office and medical properties throughout Florida. Moreover, while the deal represents a 13% premium for Retail Properties’ shareholders, the implied valuation remains a 5%-6% discount to consensus net asset value estimates.The Kite Team at Coldwell Banker Commercial Paradise is a real estate investment sales and leasing advisory team. Kite Has four sides All angles add up to three hundred sixty degrees Consecutive sides are congruent One pair of opposite angles are congruent Diagonals. As of March 31, 2021, RPAI owned 102 retail operating properties in the United States representing 19.9 million square feet. Meanwhile, the number of trustees on Kite Realty’s board will be expanded to 13 to include four members of the existing Retail Properties’ board.īTIG analyst Michael Gorman noted that while the transaction will provide Kite Realty with greater scale, the combined entity will have lower exposure to centers with grocers as an anchor and lower exposure to “warmer & cheaper” markets than the Kite Realty portfolio does on its own. is a REIT that owns and operates high quality, strategically located open-air shopping centers, including properties with a mixed-use component. The company will retain the Kite Realty name. The combined company is expected to have an equity market capitalization of approximately $4.6 billion and a total enterprise value of approximately $7.5 billion upon the closing of the transaction in the fourth quarter, assuming a Kite share price of $20.83, the closing price on July 16.

Steven Grimes, CEO of Retail Properties, said the increased scale would enable the merged company to take advantage of a reduced cost of capital as well as pursue future value creation opportunities by partnering Kite Realty’s development expertise with Retail Properties’ embedded development pipeline.

The properties in the combined company will be primarily located in “warmer and cheaper” metro markets, the companies said, with 70% of centers by annualized base rent having a grocery component. We are energized about the future of this combined company,” said John Kite, chairman and CEO of Kite Realty. “This merger further demonstrates our conviction in open-air retail centers as essential shopping destinations and last mile fulfillment centers. The transaction will create a combined operating portfolio of 185 open-air shopping centers. (NYSE: RPAI) announced a $7.5 billion merger agreement July 19 in which Retail Properties will merge into a subsidiary of Kite Realty. Shopping center REITs Kite Realty Group Trust (NYSE: KRG) and Retail Properties of America, Inc.

0 kommentar(er)

0 kommentar(er)